Why Iowa 2018 Brings Positive Changes for Iowa Employers

posted

on 9/20/2017

in

Featured Articles

Iowa employers will see some positive changes at the start of 2018. Beginning January 1, Iowa employers will see unemployment insurance taxes decrease an average of 1.5 percent on 2018 wages. The decrease is a result of the strength of the unemployment insurance trust fund, unemployment contributory wages and target levels of the unemployment insurance contributory wages. Yearly rates are determined by a formula.

“This shift is a clear signal that the integrity of our unemployment insurance trust fund is solvent and strong,” Iowa Workforce Development (IWD) Director Beth Townsend said. “A decrease in taxes to employers is a positive factor that can contribute to economic growth in the state.”

Iowa Gov. Kim Reynolds also praised the stability in the unemployment insurance trust fund.

“With our unemployment insurance trust fund consistently in the top 20, Iowa is well positioned to support our workforce and enable our employers to continue to grow their businesses,” she said. “Maintaining a low tax rate for employers will help attract new employers to the state.”

In 2018, Iowa’s employers will be in seven of eight possible tables (with eight being the most favorable). Iowa law requires IWD to establish the tax table that will be used to determine the unemployment tax rate for eligible employers each year.

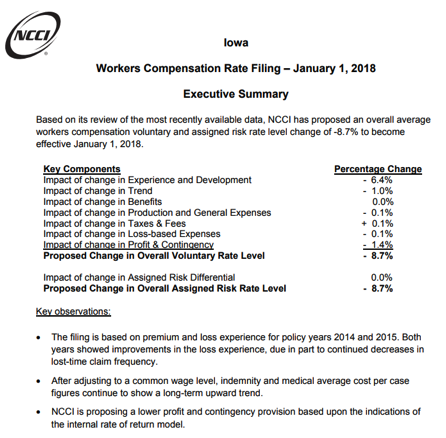

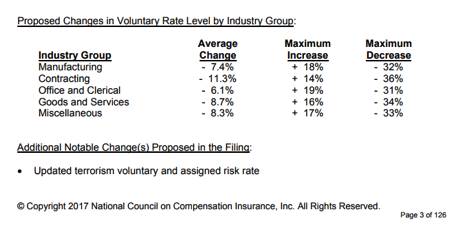

In addition to a decrease in unemployment insurance taxes, changes to the workers compensation rate will take place on January 1, 2018. The Iowa Insurance Division recently provided notice of an additional reduction in workers’ compensation premiums by 8.7 percent. The reduction is for voluntary and assigned risks for new and renewal policies. This is in addition to the 3.9 percent mid-year decrease as a result of the workers’ compensation reform legislation that was signed into law during the 2017 legislative session. See below for more information regarding the workers compensation rate from the National Council on Compensation Insurance, Inc.

Tags

- tax structure